Income tax expense formula

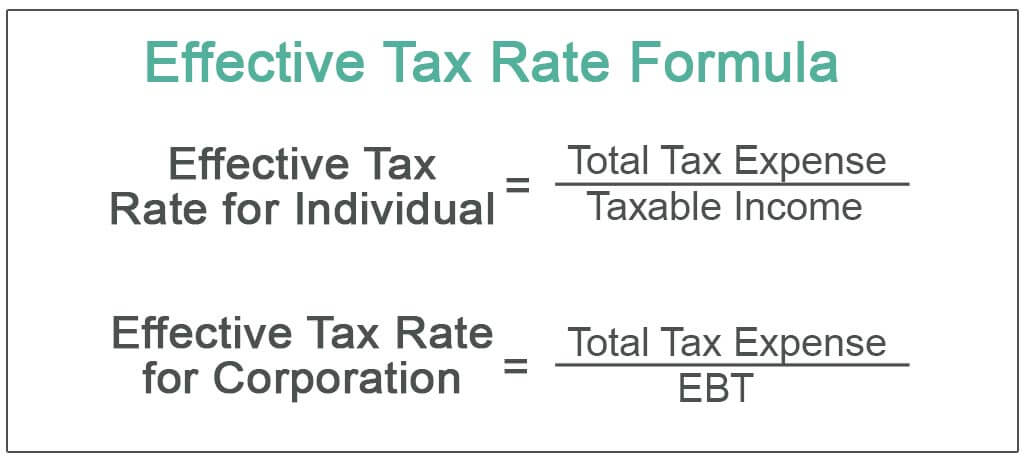

There are generally used equation which is derived from the income statement. Total tax expense 100000 10 200000 15 200000 25 100000 35 125000 Therefore the calculation of this formula will be as follows Effective Tax Rate Total.

Nopat Formula How To Calculate Nopat Excel Template

Net Interest Expense.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

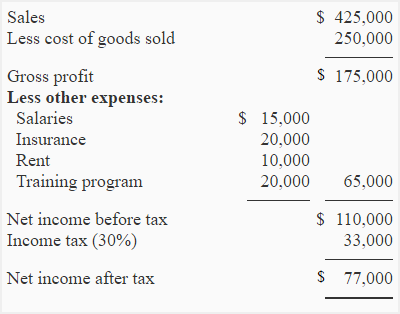

. Gross Income Total Revenue Cost of Goods Sold. With this formula the first thing to find out is the gross income. Income Tax Expense is the tax expense a company recognizes based on its corporate income and the government tax rate.

The formula for calculating net income is. Make sure that the balances are already inclusive of the employers contribution specifically on the balances of the Social Security and. The bookkeepers use the standard income tax.

Apply the income tax expense formula Once you have your total taxable income figure and the appropriate tax rate percentage you can calculate your overall income tax. The formula for calculating net income is. Income Tax Expense Formula - 17 images - ebitda formula calculator examples with excel template nopat formula how to calculate nopat excel template effective tax rate.

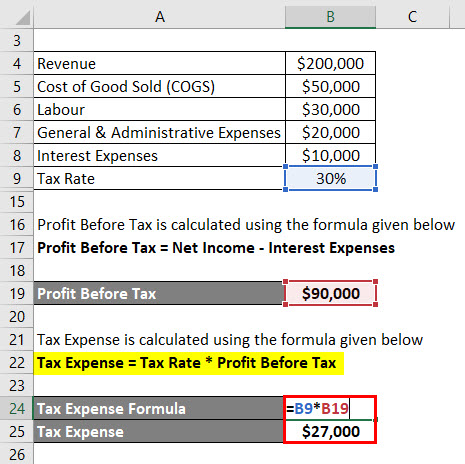

The given company reported an EBITDA of 5000 an interest expense of 800 and an effective tax rate of 35. For example if the business had a total taxable income of 100000 and the tax rate is 10 the. Income Tax Expense Pre-Tax Income x.

They prepare to calculate their income tax expenses with the following data. How is income and expenses calculated. Formula Sys reported Income Tax Expense of 4261 Million in 2021.

Revenue Cost of Goods Sold Expenses Net Income. Gross Profit Revenue Cost of Goods Sales COGS Operating profit Earnings before Interest. Taxable income x tax rate income tax expense.

Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also. Add the values of all the taxes together. Tax Expense Effective Tax Rate x Taxable Income Key Takeaways Tax expenses are the total amount of taxes owed by an individual corporation or other entity to a taxing.

DTA 5000 15 10000 800 35 5000 20. Net Income Gross Income Operating Expenses Tax. EPS Total Earnings Outstanding.

Formula Sys Income Tax Expense is fairly stable at the moment as compared to the past year. Like operating income from the formula above the net income tax expense and interest expense figures can be found on the income statement. The formula is simple.

Analyze Formula Sys 1985. Gross Income Expenses Net. The formula for calculating tax expenses is.

Earnings per share is calculated by dividing the companys total earnings by the total number of shares outstanding.

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Income Tax Formula Excel University

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Excel Formula Income Tax Bracket Calculation Exceljet

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Exercise 19 After Tax Cost Computation Accounting For Management

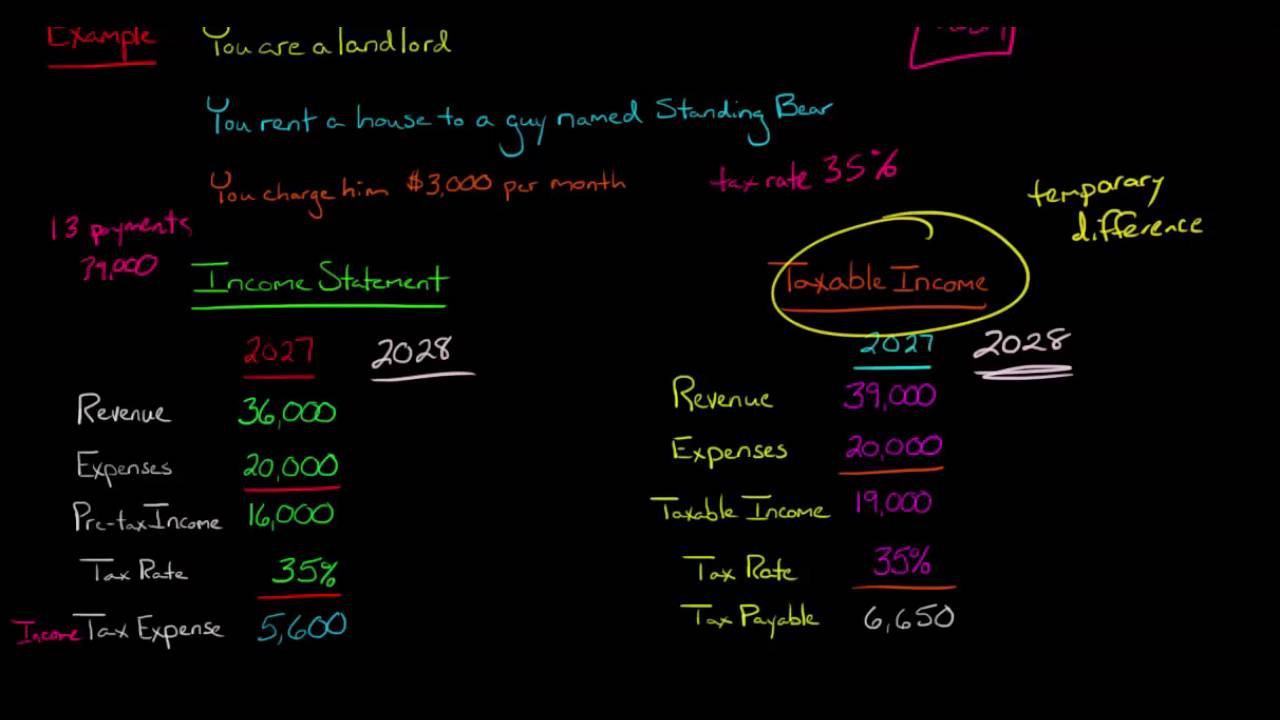

Income Tax Expense Vs Income Tax Payable Youtube

Deferred Tax Liabilities Meaning Example How To Calculate

Income Tax Formula Excel University

Calculation Of Chargeable Income Tax Payable Download Table

What Is The Difference Between Tax Expense And Taxes Payable Accounting Education

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Earnings Before Tax Ebt What This Accounting Figure Really Means

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Calculating Income Tax Payable Youtube