Tax amount calculator

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

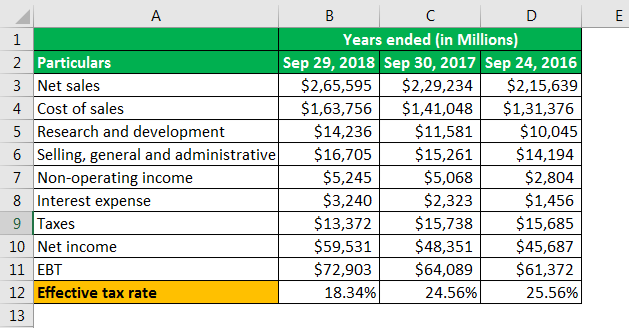

Effective Tax Rate Formula Calculator Excel Template

Find the sales tax rate of your state and local area.

. Then use this number in the multiplication process. How to Calculate Sales Tax Multiply the price of your item or service by the tax rate. We use your income location to estimate your total tax burden.

Enter the sales tax percentage. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Where the supply is made learn about the place of supply rules.

Thats where our paycheck calculator comes in. The rate you will charge depends on different factors see. Ad Our Resources Can Help You Decide Between Taxable Vs.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Please note that we can only estimate your property tax based on median property taxes in your area. The following table provides the GST and HST provincial rates since July 1 2010.

Sales Tax Calculator. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Your Results Read a full breakdown of the tax you pay.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. Example 100 8 sales tax rate 108 Next divide the total percentage by 100 to convert it to a decimal. This does not account for any other taxes you may have.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Paystubs for all jobs spouse too.

The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors including your income number of dependents and filing status. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Who the supply is made to to learn about who may not pay the GSTHST.

Tax Return Calculator Your Details Done Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year.

Enter your income and location to estimate your tax burden. Taking advantage of deductions. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Type of supply learn about what supplies are taxable or not. What You Need Have this ready. Before-tax price sale tax rate and final or after-tax price.

See What Credits and Deductions Apply to You. To use this income tax calculator simply fill in the relevant data within the green box and push Calculate. There are a variety of other ways you can lower your tax liability such as.

Does not include self-employment tax for the self-employed. Also calculated is your net income the amount you have left over after taxes or paid. That entry would be 0775 for the percentage.

52-Week Savings Calculator. Allowances Please Enter Amount. Free Income Tax Calculator - Estimate Your Taxes SmartAsset Calculate your 2019 federal state and local taxes with our free income tax calculator.

Reference a site like the Sales Tax Clearinghouse to find the rates specific to where you live Then add 100 to the tax rate. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Income Tax Calculator How much tax will I pay.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Does not include income credits or additional taxes. The sales tax added to the original purchase price produces the total cost of the purchase.

Tax Rates 202223 IMPORTANT. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one. Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Nairobi Water Bill Calculator. This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary.

Assessment Year Tax Payer Male Female Senior Citizen Residential Status Net Taxable Income Income Tax after relief us 87A Surcharge Education Cess Secondary and higher education cess Total Tax Liability. Income Tax Department Tax Tools Tax Calculator As amended upto Finance Act 2022 Tax Calculator Click here to view relevant Act Rule. Find list price and tax percentage Divide tax percentage by 100 to get tax rate as a decimal.

Ad Enter Your Tax Information. The calculator will calculate tax on your taxable income only. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading.

Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. We can also help you understand some of the key factors that affect your tax return estimate. Taxable income Your taxable income is your adjusted gross income minus deductions standard or itemized.

There are typically multiple rates in a given area because your state county local. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. 108 total percentage 100 108.

Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. If you are looking to find out your take-home pay from your salary we recommend using our Pay As You Earn.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. Use Our Free Powerful Software to Estimate Your Taxes.

Sales Tax Calculator

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Sales Tax Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template

Sales Tax Calculator

Lottery Tax Calculator

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

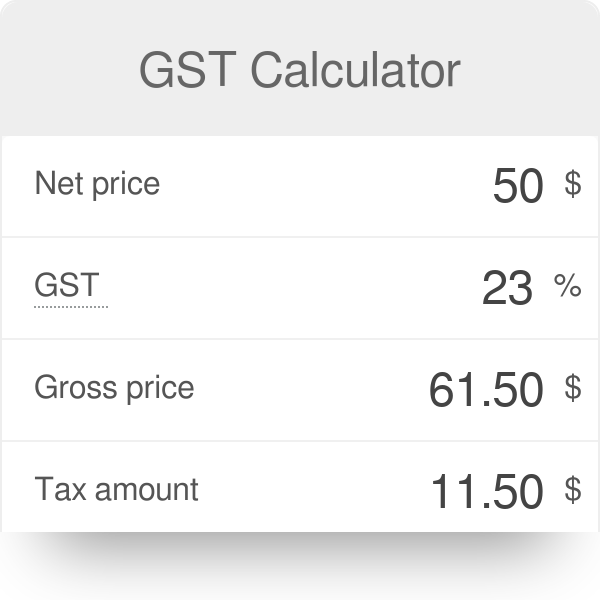

Gst Calculator How To Calculate Gst

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Gross To Net Calculator

Effective Tax Rate Formula Calculator Excel Template